There are a couple of answers to the question of How do I sell my house for the most money? There are also many things to consider when answering this question.

First, and most generally, obtaining the highest price for your house means preparing it for sale (optimizing curb appeal, addressing repairs prior to listing, etc.) and getting the most exposure possible by listing it on the MLS using a reputable and motivated realtor and using marketing techniques to maximize your buyer pool. In other words, making your house the ‘best product’ on the market that it can be is your best shot at getting top dollar.

It’s also possible to achieve this or a similar result listing your house For Sale by Owner and the trade-off of not having realtor fees may result in more money in your pocket at closing (but you risk having less visibility to potential buyers and not finding the buyer who will pay the most).

However, the above response assumes that ‘most money’ refers to receiving all of your proceeds at the closing. What if you don’t need all of that money right away? What if that big lump sum would be a major tax liability? Well, in this case, you might be able to negotiate an even higher price if the terms work for the buyer. Or you might be able to sell for the same or lower price but with terms that work better for you. For these options, a cash buyer or sophisticated wholesaler might be your best bet.

To dive in a bit further, here are the big questions you may want to think through regarding How do I sell my house for the most money? To cut to the chase, learn how to avoid cash house buyers in Kalamazoo.

- Is the highest dollar value of the sale price what you want?

- If obtaining the highest possible sales price is your goal, assuming you want to receive your proceeds at closing, you probably want to strategize this with your realtor. In addition to having your house in show-ready condition, staged beautifully, and marketed with excellence, you can communicate to your potential buyers in a variety of ways that price is most important to you (over other sale conditions and terms of sale). For example, in your marketing or negotiations you may offer up concessions such as contribution to buyer closing costs and prepaids. Or agree to make repairs prior to closing. Or allowing the buyer to rent the house prior to closing if it’s vacant. Or catering to the buyer’s desired timeline. Or a

- If obtaining the highest possible sales price is your goal and you are willing to defer your income over time, you may be able to sell for an even HIGHER sales price by selling via an installment sale for How do I sell my house for the most money?

- Is the largest amount of proceeds you receive at closing what you are after?

- The majority of people who sell their home are looking to receive their proceeds in whole at the close of the sale rather than defer the income over time. This can be for a variety of reasons. As homes are the primary store of value for most American homeowners, most people are looking to extract that value when they sell their house. It might be so that they can utilize it for the purchase of another house. Or they might be looking to move their equity into another investment such as bitcoin, stocks, bonds, investment real estate, etc. It can also be attributed to national custom as it is just the social norm to sell your house and receive the full proceeds at closing.

- Is the largest amount of proceeds, even if spread over time, your goal?

- A smaller percentage of people think through the sale of their home (it may be their primary residence, an investment property, an inherited property, etc.) and consider other options regarding the best use of their equity. Or an investor brings the idea to them. The concept of selling via an installment sale whereby the homeowner sells their house and receives payments over time can provide multiple benefits to the homeowner.

First, someone may be willing to pay ABOVE market value to purchase the home off-market on terms in order to How do I sell my house for the most money?

- Why? The buyer may be qualified to make payments but because they are self-employed or for other reasons they may not want or qualify for a traditional mortgage. They may be willing to pay a premium if the seller accepts payments over time. Or the buyer may be a savvy investor who is not only avoiding banks but structuring the payment terms to work for his benefit.

Second, there may be tax benefits to selling a property and receiving the proceeds over multiple years. With many other types of investments, the investment holder is rewarded with a lower tax rate on their gains if they hold the asset for a longer period of time (long term vs short term capital gains taxes). With real estate (excluding homestead exceptions), the profit from selling a house is also taxed. There are many details and nuances of how the tax owed is calculated but that is not the focus of this article. With regards to How do I sell my house for the most money? You may be able to receive the most money selling via payments over time if doing so will reduce your income and associated tax liability. This is most often observed with investment real estate (as homestead exemption does not apply).

- Here is a simple example using just the basics (ignoring things such as depreciation recapture): Jane buys a rental house for $100,000. 30 years later she sells the house for $400,000. Assuming no cost of sale, her profit is $300,000.

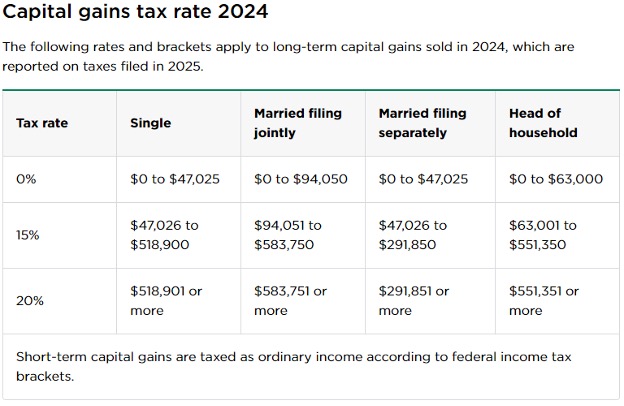

- She will need to pay capital gains on the $300,000. Those taxes, as of 2024, could be 0% – 20% (a huge range!). Refer to the chart below for specifics.

- So, if Jane was married filing jointly with an income of $40,000 per year, she might be able to take payments of $4000 per month until paid off ($48,000 per year) and pay ZERO capital gains taxes!

- Accepting the full proceeds from the sale would have resulted in Jane’s income for the year being $340,000 which would have put her in the 20% tax bracket. If she went this route she would have to pay 20% of the gain in long term capital gains tax ($60,000!).

This article does not constitute financial or legal advice for How do I sell my house for the most money?

Here are the 2024 long term capital gains brackets (from https://www.nerdwallet.com/article/taxes/capital-gains-tax-rates) :